Different countries have different tax norms and rates so accordingly you can apply them on your eCommerece framework based theme products using these steps. These taxes will be visible on the product checkout page and will be added into the total bill value of a user who purchase the respective product.

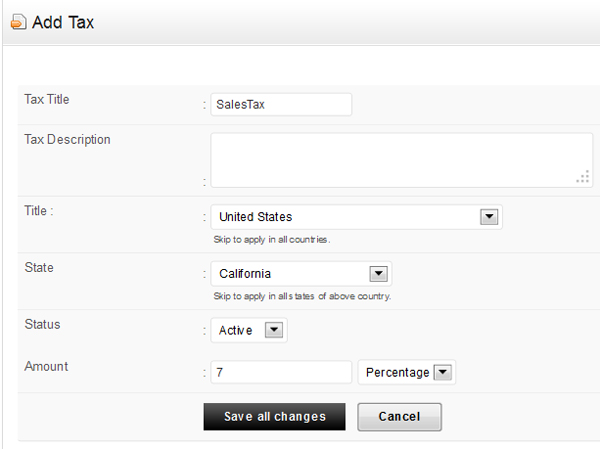

To add a new Tax:

- Go to wp-admin -> Theme options -> Manage Tax

- Enter the “Title”. It could be anything

- Enter the “Tax Description”. e.g. Tax for California

- Select the Country to which you want to apply this tax, e.g. United States

- Select the State, e.g. California

- Set the “status” as active

- Set the “Amount” as per your wish. This could be in Percentage or Amount. (Note: Amount means a flat tax will apply, e.g. $10, so this $10 will be charged to the customer, no matter how much amount of products he/she purchases)

- Click on Submit

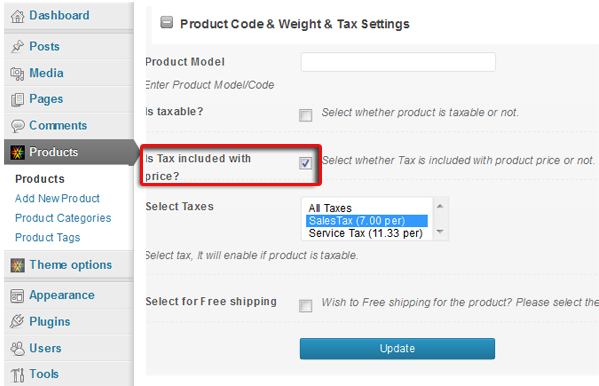

How to apply this tax on your product?

After creating your tax,

- Go to wp-admin -> Products

- Add/edit the product to which you want to add tax

- There under the section “Product Code & Weight & Tax Settings”, select “Is taxable?” option and click update

Same way, you can also select the option “Is Tax included with price?” when you do not want to apply additional tax on your product.

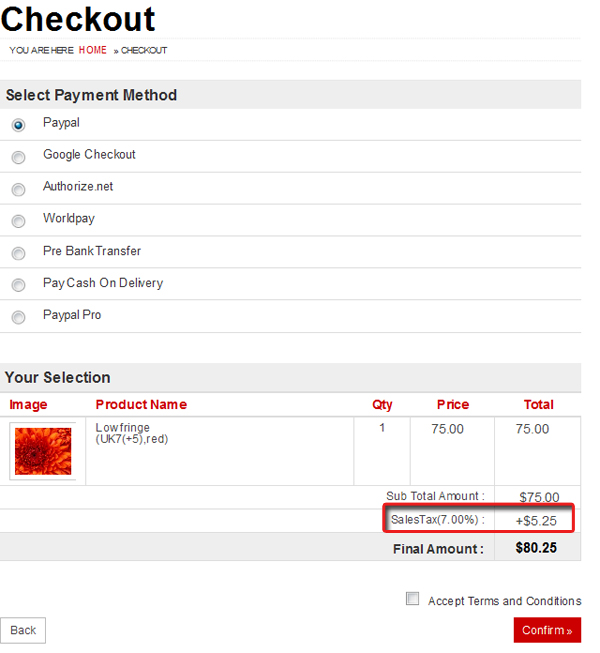

How it works on front-end?

After following all the above said steps, this is how it will appear when anyone checkout after purchasing any product from your site,

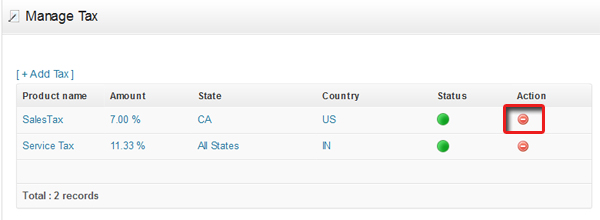

How to delete a tax ?

- Go to wp-admin -> Theme options and click on “Manage Tax”

- Simply click on “Delete” icon given under the column “Action” to delete that tax system

- Or you can simply set the status as “Inactive” by editing that particular tax system, instead of deleting it completely.